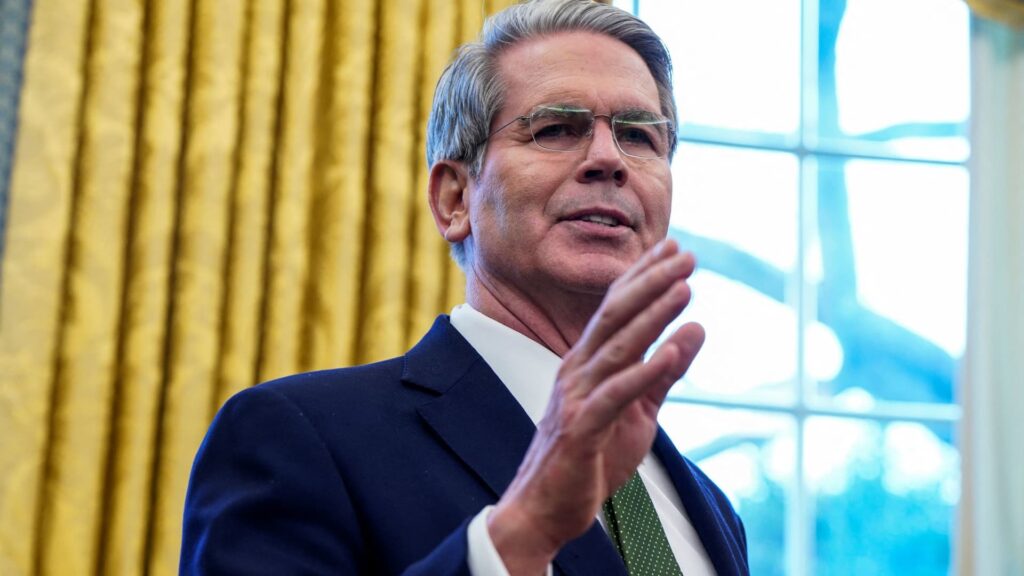

Bessent’s Bold Claim: China to Absorb Trump’s Tariffs, Minimizing Inflation Impact

U.S. Secretary of the Treasury, Scott Bessent, expressed confidence that President Donald Trump’s proposed tariffs would not significantly fuel inflation, asserting that China would effectively ‘eat’ the costs. These remarks were delivered on Sunday, a mere two days before the scheduled implementation of tariffs on imports from Mexico and Canada. How is that posibble? let we discuses in this article and what the impact of this moment.

The planned tariffs encompass a 25% levy on goods from Mexico and Canada, alongside an additional 10% duty on Chinese imports, supplementing the existing 10% tariff imposed on February 4th. The unfolding trade tensions have ignited concerns among some economists, who foresee potential inflationary pressures and the prospect of sustained elevated interest rates extending into 2026.What did bissent say about the tarifs? What the reaction from other parties? Why tariffs can give impact to economic?

Bessent’s Reassurance and China’s Stance

When questioned on CBS’s ‘Face the Nation’ about the potential repercussions of the tariffs on average households, Bessent offered a measured response. How about Bessent’s responses? He acknowledged the uncertainty inherent in the situation, emphasizing its path-dependent nature, but unequivocally stated his lack of concern regarding China’s response. Bessent posited that China’s export-oriented business model would compel them to absorb the tariffs, thereby mitigating the inflationary impact on the U.S. economy.

China’s Ministry of Commerce, however, swiftly and firmly opposed Trump’s latest tariff escalation, vowing to retaliate as deemed necessary. This stance mirrors China’s response to the initial round of tariffs in February, when they raised duties on specific U.S. energy imports and added two U.S. companies to an “unreliable entities list.” What kind the stance from China?Experts anticipate similar countermeasures in response to the newly imposed tariffs. A Ministry of Commerce spokesperson reiterated to CNBC China’s commitment to defending its legitimate rights and interests through all necessary means.

Mexico’s Proposal and Canada’s Silence

Bessent also revisited his earlier comments regarding Mexico’s proposal to match the U.S. tariffs on China, a move aimed at preempting the imposition of Trump’s tariffs. He further urged Canada to consider emulating Mexico’s proposition. While acknowledging Mexico’s offer, Bessent noted the absence of communication from the Canadians, expressing optimism that such a step would constitute a positive development. He hinted at potential announcements from both countries on Tuesday, the scheduled implementation date, or, alternatively, the erection of a tariff wall, with subsequent developments yet to unfold.Why Mexico’s has proposal? And why Canada’s silence?

The Potential Impact: Inflation and Interest Rates

The core of the debate revolves around the potential for these tariffs to trigger inflation. Economists have voiced concerns that the increased cost of imported goods could translate into higher prices for consumers. This, in turn, could pressure the Federal Reserve to maintain elevated interest rates for a longer period, potentially extending into 2026. Higher interest rates can impact borrowing costs for businesses and individuals, potentially slowing down economic growth. So,what the impact in the future? The tariffs’ effects on inflation and, consequently, interest rates are crucial factors shaping the economic landscape.

China’s “Business Model” and Retaliation

Bessent’s argument hinges on the belief that China’s “business model” – its heavy reliance on exports – will force it to absorb the tariffs rather than pass them on to consumers. How China responds? This is a key assumption in his prediction of minimal inflationary impact. China, however, has consistently stated its intention to retaliate. Previous actions, such as raising duties on U.S. energy imports and blacklisting U.S. companies, demonstrate its willingness to respond in kind. This tit-for-tat exchange of tariffs raises significant questions about the potential for a prolonged trade war.

Uncertainty and “Path-Dependent” Outcomes

Bessent himself acknowledged the inherent uncertainty surrounding the situation, describing the outcomes as “path-dependent.” This means that the ultimate impact of the tariffs will depend on a series of evolving factors, including the actions and reactions of all parties involved. The evolving situation creates a complex web of interconnected events that will continue to be in the future. The actual outcomes may vary significantly depending on how these events unfold.

The Unfolding Trade Saga: A Summary

The trade tensions between the U.S., China, Mexico, and Canada have entered a new phase with President Trump’s proposed tariff increases. Treasury Secretary Bessent remains confident that China will absorb the tariffs, thus minimizing inflationary pressure. However, China has vowed to retaliate, raising concerns about a escalating trade war. Mexico has offered to mirror U.S. tariffs on China to avoid penalties, while Canada’s position remains unclear. The potential for inflation and prolonged high interest rates is a significant concern among economists. The “path-dependent” nature of the situation highlights the ongoing uncertainty and the complex interplay of actions and reactions that will shape the final outcome. The economic ramifications of these trade disputes remain to be seen, with potential impacts on global trade and economic growth.

You may also like

-

March Madness 2024: Tennessee Ascends to No. 1 Seed, Bubble Drama Intensifies

-

Kyrie Irving’s Season Cut Short: A Deep Dive into the Impact of His ACL Tear

-

NBA Playoff Projections: Cavs’ Strong Odds and Western Conference Battles

-

Firefly Aerospace’s Blue Ghost Achieves Historic Lunar Landing

-

Understanding Copyright and Responsible Gambling: A Guide for Users of GDC Media, Roto Sports, and Affiliates